Pareto distribution

Template:Short description Template:CS1 config Template:Infobox probability distribution</math>

| cdf =<math>1-\left(\frac{x_\mathrm{m}}{x}\right)^\alpha</math>

| quantile = <math>x_\mathrm{m} {(1 - p)}^{-\frac{1}{\alpha}}</math>

| mean =<math>\begin{cases}

\infty & \text{for }\alpha\le 1 \\

\dfrac{\alpha x_\mathrm{m}}{\alpha-1} & \text{for }\alpha>1

\end{cases}</math>

| median =<math>x_\mathrm{m} \sqrt[\alpha]{2}</math>

| mode =<math>x_\mathrm{m}</math>

| variance =<math>\begin{cases}

\infty & \text{for }\alpha\le 2 \\

\dfrac{x_\mathrm{m}^2\alpha}{(\alpha- 1)^2(\alpha-2)} & \text{for }\alpha>2

\end{cases}</math>

| skewness =<math>\frac{2(1+\alpha)}{\alpha-3}\sqrt{\frac{\alpha-2}{\alpha}}\text{ for }\alpha>3</math>

| kurtosis =<math>\frac{6(\alpha^3+\alpha^2-6\alpha-2)}{\alpha(\alpha-3)(\alpha-4)}\text{ for }\alpha>4</math>

| entropy =<math>\log\left(\left(\frac{x_\mathrm{m}}{\alpha}\right)\,e^{1+\tfrac{1}{\alpha}}\right) </math>

| mgf =does not exist

| char =<math>\alpha(-ix_\mathrm{m}t)^\alpha\Gamma(-\alpha,-ix_\mathrm{m}t)</math>

| fisher =<math>\mathcal{I}(x_\mathrm{m},\alpha) = \begin{bmatrix}

\dfrac{\alpha^2}{x_\mathrm{m}^2} & 0 \\

0 & \dfrac{1}{\alpha^2}

\end{bmatrix}</math>

| ES =<math>\frac{ x_m \alpha }{ (1-p)^{\frac{1}{\alpha}} (\alpha-1)}</math><ref name="norton">Template:Cite journal</ref>

| bPOE =<math>\left( \frac{x_m \alpha}{x(\alpha-1) } \right)^\alpha </math><ref name="norton"/>

}}

The Pareto distribution, named after the Italian civil engineer, economist, and sociologist Vilfredo Pareto,<ref>Template:Cite journal</ref> is a power-law probability distribution that is used in description of social, quality control, scientific, geophysical, actuarial, and many other types of observable phenomena; the principle originally applied to describing the distribution of wealth in a society, fitting the trend that a large portion of wealth is held by a small fraction of the population.<ref>Template:Cite journal</ref><ref name=":1"/>

The Pareto principle or "80:20 rule" stating that 80% of outcomes are due to 20% of causes was named in honour of Pareto, but the concepts are distinct, and only Pareto distributions with shape value (Template:Math) Template:Nobr precisely reflect it. Empirical observation has shown that this 80:20 distribution fits a wide range of cases, including natural phenomena<ref>Template:Cite journal</ref> and human activities.<ref>Template:Cite journal</ref><ref>Template:Cite web</ref>

Definitions

If X is a random variable with a Pareto (Type I) distribution,<ref name=arnold>Template:Cite book</ref> then the probability that X is greater than some number x, i.e., the survival function (also called tail function), is given by

<math display="block">\overline{F}(x) = \Pr(X>x) = \begin{cases} \left(\frac{x_\mathrm{m}}{x}\right)^\alpha & x\ge x_\mathrm{m}, \\ 1 & x < x_\mathrm{m}, \end{cases} </math>

where xm is the (necessarily positive) minimum possible value of X, and α is a positive parameter. The type I Pareto distribution is characterized by a scale parameter xm and a shape parameter α, which is known as the tail index. If this distribution is used to model the distribution of wealth, then the parameter α is called the Pareto index.

Cumulative distribution function

From the definition, the cumulative distribution function of a Pareto random variable with parameters α and xm is

<math display="block">F_X(x) = \begin{cases} 1-\left(\frac{x_\mathrm{m}}{x}\right)^\alpha & x \ge x_\mathrm{m}, \\ 0 & x < x_\mathrm{m}. \end{cases}</math>

Probability density function

It follows (by differentiation) that the probability density function is

<math display="block">f_X(x)= \begin{cases} \frac{\alpha x_\mathrm{m}^\alpha}{x^{\alpha+1}} & x \ge x_\mathrm{m}, \\ 0 & x < x_\mathrm{m}. \end{cases} </math>

When plotted on linear axes, the distribution assumes the familiar J-shaped curve which approaches each of the orthogonal axes asymptotically. All segments of the curve are self-similar (subject to appropriate scaling factors). When plotted in a log–log plot, the distribution is represented by a straight line.

Properties

Moments and characteristic function

- The expected value of a random variable following a Pareto distribution is <math display="block">\operatorname{E}(X) = \begin{cases}

\infty & \alpha\le 1, \\ \frac{\alpha x_{\mathrm{m}}}{\alpha-1} & \alpha>1. \end{cases}</math>

- The variance of a random variable following a Pareto distribution is <math display="block">\operatorname{Var}(X)= \begin{cases}

\infty & \alpha\in(1,2], \\ \left(\frac{x_\mathrm{m}}{\alpha-1}\right)^2 \frac{\alpha}{\alpha-2} & \alpha>2. \end{cases}</math> (If α ≤ 1, the variance does not exist.)

- The raw moments are <math display="block">\mu_n'= \begin{cases} \infty & \alpha\le n, \\ \frac{\alpha x_\mathrm{m}^n}{\alpha-n} & \alpha>n. \end{cases}</math>

- The moment generating function is only defined for non-positive values t ≤ 0 as <math display="block">M\left(t;\alpha,x_\mathrm{m}\right) = \operatorname{E} \left [e^{tX} \right ] = \alpha(-x_\mathrm{m} t)^\alpha\Gamma(-\alpha,-x_\mathrm{m} t)</math> <math display="block">M\left(0,\alpha,x_\mathrm{m}\right)=1.</math> Thus, since the expectation does not converge on an open interval containing <math>t=0</math> we say that the moment generating function does not exist.

- The characteristic function is given by <math display="block">\varphi(t;\alpha,x_\mathrm{m})=\alpha(-ix_\mathrm{m} t)^\alpha\Gamma(-\alpha,-ix_\mathrm{m} t),</math> where Γ(a, x) is the incomplete gamma function.

The parameters may be solved for using the method of moments.<ref>S. Hussain, S.H. Bhatti (2018). Parameter estimation of Pareto distribution: Some modified moment estimators. Maejo International Journal of Science and Technology 12(1):11-27.</ref>

Conditional distributions

The conditional probability distribution of a Pareto-distributed random variable, given the event that it is greater than or equal to a particular number <math>x_1</math> exceeding <math>x_\text{m}</math>, is a Pareto distribution with the same Pareto index <math>\alpha</math> but with minimum <math>x_1</math> instead of <math>x_\text{m}</math>:

<math display="block"> \text{Pr}(X \geq x | X \geq x_1) = \begin{cases} \left(\frac{x_1}{x}\right)^\alpha & x \geq x_1, \\ 1 & x < x_1. \end{cases}</math>

This implies that the conditional expected value (if it is finite, i.e. <math>\alpha>1</math>) is proportional to <math>x_1</math>:

<math display="block">\text{E}(X | X \geq x_1) \propto x_1.</math>

In case of random variables that describe the lifetime of an object, this means that life expectancy is proportional to age, and is called the Lindy effect or Lindy's Law.<ref name=":02">Template:Cite journal</ref>

A characterization theorem

Suppose <math>X_1, X_2, X_3, \dotsc</math> are independent identically distributed random variables whose probability distribution is supported on the interval <math>[x_\text{m},\infty)</math> for some <math>x_\text{m}>0</math>. Suppose that for all <math>n</math>, the two random variables <math>\min\{X_1,\dotsc,X_n\}</math> and <math>(X_1+\dotsb+X_n)/\min\{X_1,\dotsc,X_n\}</math> are independent. Then the common distribution is a Pareto distribution.Template:Citation needed

Geometric mean

The geometric mean (G) is<ref name=Johnson1994>Johnson NL, Kotz S, Balakrishnan N (1994) Continuous univariate distributions Vol 1. Wiley Series in Probability and Statistics.</ref>

<math display="block"> G = x_\text{m} \exp \left( \frac{1}{\alpha} \right).</math>

Harmonic mean

The harmonic mean (H) is<ref name="Johnson1994"/>

<math display="block"> H = x_\text{m} \left( 1 + \frac{ 1 }{ \alpha } \right).</math>

Graphical representation

The characteristic curved 'long tail' distribution, when plotted on a linear scale, masks the underlying simplicity of the function when plotted on a log-log graph, which then takes the form of a straight line with negative gradient: It follows from the formula for the probability density function that for x ≥ xm,

<math display="block">\log f_X(x)= \log \left(\alpha\frac{x_\mathrm{m}^\alpha}{x^{\alpha+1}}\right) = \log (\alpha x_\mathrm{m}^\alpha) - (\alpha+1) \log x.</math>

Since α is positive, the gradient −(α + 1) is negative.

Related distributions

Generalized Pareto distributions

There is a hierarchy <ref name=arnold/><ref name=jkb94>Johnson, Kotz, and Balakrishnan (1994), (20.4).</ref> of Pareto distributions known as Pareto Type I, II, III, IV, and Feller–Pareto distributions.<ref name=arnold/><ref name=jkb94/><ref name=kk03>Template:Cite book</ref> Pareto Type IV contains Pareto Type I–III as special cases. The Feller–Pareto<ref name=jkb94/><ref name=feller>Template:Cite book "The densities (4.3) are sometimes called after the economist Pareto. It was thought (rather naïvely from a modern statistical standpoint) that income distributions should have a tail with a density ~ Ax−α as x → ∞".</ref> distribution generalizes Pareto Type IV.

Pareto types I–IV

The Pareto distribution hierarchy is summarized in the next table comparing the survival functions (complementary CDF).

When μ = 0, the Pareto distribution Type II is also known as the Lomax distribution.<ref>Template:Cite journal</ref>

In this section, the symbol xm, used before to indicate the minimum value of x, is replaced by σ.

| <math> \overline{F}(x)=1-F(x)</math> | Support | Parameters | |

|---|---|---|---|

| Type I | <math>\left[\frac x \sigma \right]^{-\alpha}</math> | <math>x \ge \sigma</math> | <math>\sigma > 0, \alpha</math> |

| Type II | <math>\left[1 + \frac{x-\mu} \sigma \right]^{-\alpha}</math> | <math>x \ge \mu</math> | <math>\mu \in \mathbb R, \sigma > 0, \alpha</math> |

| Lomax | <math>\left[1 + \frac x \sigma \right]^{-\alpha}</math> | <math>x \ge 0</math> | <math>\sigma > 0, \alpha</math> |

| Type III | <math>\left[1 + \left(\frac{x-\mu} \sigma \right)^{1/\gamma}\right]^{-1} </math> | <math>x \ge \mu</math> | <math> \mu \in \mathbb R, \sigma, \gamma > 0</math> |

| Type IV | <math>\left[1 + \left(\frac{x-\mu} \sigma \right)^{1/\gamma}\right]^{-\alpha}</math> | <math>x \ge \mu</math> | <math>\mu \in \mathbb R, \sigma, \gamma > 0, \alpha</math> |

The shape parameter α is the tail index, μ is location, σ is scale, γ is an inequality parameter. Some special cases of Pareto Type (IV) are

<math display="block"> P(IV)(\sigma, \sigma, 1, \alpha) = P(I)(\sigma, \alpha),</math> <math display="block"> P(IV)(\mu, \sigma, 1, \alpha) = P(II)(\mu, \sigma, \alpha),</math> <math display="block"> P(IV)(\mu, \sigma, \gamma, 1) = P(III)(\mu, \sigma, \gamma).</math>

The finiteness of the mean, and the existence and the finiteness of the variance depend on the tail index α (inequality index γ). In particular, fractional δ-moments are finite for some δ > 0, as shown in the table below, where δ is not necessarily an integer.

| <math>\operatorname{E}[X]</math> | Condition | <math>\operatorname{E}[X^\delta]</math> | Condition | |

|---|---|---|---|---|

| Type I | <math>\frac{\sigma \alpha}{\alpha-1}</math> | <math>\alpha > 1</math> | <math>\frac{\sigma^\delta \alpha}{\alpha-\delta}</math> | <math> \delta < \alpha</math> |

| Type II | <math> \frac{ \sigma }{\alpha-1}+\mu</math> | <math>\alpha > 1</math> | <math> \frac{ \sigma^\delta \Gamma(\alpha-\delta)\Gamma(1+\delta)}{\Gamma(\alpha)}</math> | <math>0 < \delta < \alpha, \mu=0</math> |

| Type III | <math>\sigma\Gamma(1-\gamma)\Gamma(1 + \gamma)</math> | <math> -1<\gamma<1</math> | <math>\sigma^\delta\Gamma(1-\gamma \delta)\Gamma(1+\gamma \delta)</math> | <math>-\gamma^{-1}<\delta<\gamma^{-1}</math> |

| Type IV | <math>\frac{\sigma\Gamma(\alpha-\gamma)\Gamma(1+\gamma)}{\Gamma(\alpha)}</math> | <math> -1<\gamma<\alpha</math> | <math>\frac{\sigma^\delta\Gamma(\alpha-\gamma \delta)\Gamma(1+\gamma \delta)}{\Gamma(\alpha)}</math> | <math>-\gamma^{-1}<\delta<\alpha/\gamma </math> |

Feller–Pareto distribution

Feller<ref name=jkb94/><ref name=feller/> defines a Pareto variable by transformation U = Y−1 − 1 of a beta random variable ,Y, whose probability density function is

<math display="block"> f(y) = \frac{y^{\gamma_1-1} (1-y)^{\gamma_2-1}}{B(\gamma_1, \gamma_2)}, \qquad 0<y<1; \gamma_1,\gamma_2>0,</math>

where B( ) is the beta function. If

<math display="block"> W = \mu + \sigma(Y^{-1}-1)^\gamma, \qquad \sigma>0, \gamma>0,</math>

then W has a Feller–Pareto distribution FP(μ, σ, γ, γ1, γ2).<ref name=arnold/>

If <math>U_1 \sim \Gamma(\delta_1, 1)</math> and <math>U_2 \sim \Gamma(\delta_2, 1)</math> are independent Gamma variables, another construction of a Feller–Pareto (FP) variable is<ref>Template:Cite book</ref>

<math display="block">W = \mu + \sigma \left(\frac{U_1}{U_2}\right)^\gamma</math>

and we write W ~ FP(μ, σ, γ, δ1, δ2). Special cases of the Feller–Pareto distribution are

<math display="block">FP(\sigma, \sigma, 1, 1, \alpha) = P(I)(\sigma, \alpha)</math> <math display="block">FP(\mu, \sigma, 1, 1, \alpha) = P(II)(\mu, \sigma, \alpha)</math> <math display="block">FP(\mu, \sigma, \gamma, 1, 1) = P(III)(\mu, \sigma, \gamma)</math> <math display="block">FP(\mu, \sigma, \gamma, 1, \alpha) = P(IV)(\mu, \sigma, \gamma, \alpha).</math>

Inverse-Pareto Distribution / Power Distribution

When a random variable <math>Y</math> follows a pareto distribution, then its inverse <math>X=1/Y</math> follows a Power distribution. Inverse Pareto distribution is equivalent to a Power distribution<ref>Template:Cite journal</ref>

<math display="block">Y\sim \mathrm{Pa}(\alpha, x_m) = \frac{\alpha x_m^\alpha}{y^{\alpha+1}} \quad (y \ge x_m) \quad \Leftrightarrow \quad X\sim \mathrm{iPa}(\alpha, x_m) = \mathrm{Power}(x_m^{-1}, \alpha) = \frac{\alpha x^{\alpha-1}}{(x_m^{-1})^\alpha} \quad (0< x \le x_m^{-1})</math>

Relation to the exponential distribution

The Pareto distribution is related to the exponential distribution as follows. If X is Pareto-distributed with minimum xm and index α, then

<math display="block"> Y = \log\left(\frac{X}{x_\mathrm{m}}\right) </math>

is exponentially distributed with rate parameter α. Equivalently, if Y is exponentially distributed with rate α, then

<math display="block"> x_\mathrm{m} e^Y</math>

is Pareto-distributed with minimum xm and index α.

This can be shown using the standard change-of-variable techniques:

<math display="block"> \begin{align} \Pr(Y<y) & = \Pr\left(\log\left(\frac{X}{x_\mathrm{m}}\right)<y\right) \\ & = \Pr(X<x_\mathrm{m} e^y) = 1-\left(\frac{x_\mathrm{m}}{x_\mathrm{m}e^y}\right)^\alpha=1-e^{-\alpha y}. \end{align} </math>

The last expression is the cumulative distribution function of an exponential distribution with rate α.

Pareto distribution can be constructed by hierarchical exponential distributions.<ref>Template:Cite thesis section 5.3.1.</ref> Let <math>\phi | a \sim \text{Exp}(a)</math> and <math>\eta | \phi \sim \text{Exp}(\phi) </math>. Then we have <math>p(\eta | a) = \frac{a}{(a+\eta)^2}</math> and, as a result, <math>a+\eta \sim \text{Pareto}(a, 1)</math>.

More in general, if <math>\lambda \sim \text{Gamma}(\alpha, \beta)</math> (shape-rate parametrization) and <math>\eta | \lambda \sim \text{Exp}(\lambda) </math>, then <math>\beta + \eta \sim \text{Pareto}(\beta, \alpha)</math>.

Equivalently, if <math>Y \sim \text{Gamma}(\alpha,1) </math> and <math>X \sim \text{Exp}(1)</math>, then <math>x_{\text{m}} \! \left(1 + \frac{X}{Y}\right) \sim \text{Pareto}(x_{\text{m}}, \alpha)</math>.

Relation to the log-normal distribution

The Pareto distribution and log-normal distribution are alternative distributions for describing the same types of quantities. One of the connections between the two is that they are both the distributions of the exponential of random variables distributed according to other common distributions, respectively the exponential distribution and normal distribution. (See the previous section.)

Relation to the generalized Pareto distribution

The Pareto distribution is a special case of the generalized Pareto distribution, which is a family of distributions of similar form, but containing an extra parameter in such a way that the support of the distribution is either bounded below (at a variable point), or bounded both above and below (where both are variable), with the Lomax distribution as a special case. This family also contains both the unshifted and shifted exponential distributions.

The Pareto distribution with scale <math>x_m</math> and shape <math>\alpha</math> is equivalent to the generalized Pareto distribution with location <math>\mu=x_m</math>, scale <math>\sigma=x_m/\alpha</math> and shape <math>\xi=1/\alpha</math> and, conversely, one can get the Pareto distribution from the GPD by taking <math>x_m = \sigma/\xi</math> and <math>\alpha=1/\xi</math> if <math>\xi > 0</math>.

Bounded Pareto distribution

Template:See also Template:Probability distribution{1-\left(\frac{L}{H}\right)^\alpha}</math>

| cdf =<math>\frac{1-L^\alpha x^{-\alpha}}{1-\left(\frac{L}{H}\right)^\alpha}</math>

| mean =

<math>\begin{cases} \frac{L^\alpha}{1 - \left(\frac{L}{H}\right)^\alpha} \left(\frac{\alpha}{\alpha-1}\right) \left(\frac{1}{L^{\alpha-1}} - \frac{1}{H^{\alpha-1}}\right), & \alpha\neq 1 \\ \frac{{H}{L}}{{H}-{L}}\ln\frac{H}{L}, & \alpha=1 \end{cases}</math>

| median = <math> L \left(1- \frac{1}{2}\left(1-\left(\frac{L}{H}\right)^\alpha\right)\right)^{-\frac{1}{\alpha}}</math>

| mode =

| variance =

<math>\begin{cases} \frac{L^\alpha}{1 - \left(\frac{L}{H}\right)^\alpha} \left(\frac{\alpha}{\alpha-2}\right) \left(\frac{1}{L^{\alpha-2}} - \frac{1}{H^{\alpha-2}}\right), & \alpha\neq 2 \\ \frac{2{H}^2{L}^2}{{H}^2-{L}^2}\ln\frac{H}{L}, & \alpha=2 \end{cases}</math> (this is the second raw moment, not the variance)

| skewness = <math>\frac{L^{\alpha}}{1-\left(\frac{L}{H}\right)^{\alpha}} \cdot \frac{\alpha (L^{k-\alpha}-H^{k-\alpha})}{(\alpha-k)}, \alpha \neq j </math>

(this is the kth raw moment, not the skewness)

| kurtosis = | entropy = | mgf = | char =

}}

The bounded (or truncated) Pareto distribution has three parameters: α, L and H. As in the standard Pareto distribution α determines the shape. L denotes the minimal value, and H denotes the maximal value.

The probability density function is

<math display="block">\frac{\alpha L^\alpha x^{-\alpha - 1}}{1-\left(\frac{L}{H}\right)^\alpha},</math>

where L ≤ x ≤ H, and α > 0.

Generating bounded Pareto random variables

If U is uniformly distributed on (0, 1), then applying inverse-transform method <ref>Template:Cite web</ref>

<math display="block">U = \frac{1 - L^\alpha x^{-\alpha}}{1 - (\frac{L}{H})^\alpha}</math> <math display="block">x = \left(-\frac{U H^\alpha - U L^\alpha - H^\alpha}{H^\alpha L^\alpha}\right)^{-\frac{1}{\alpha}}</math>

is a bounded Pareto-distributed. Template:Clear

Symmetric Pareto distribution

The purpose of the Symmetric and Zero Symmetric Pareto distributions is to capture some special statistical distribution with a sharp probability peak and symmetric long probability tails. These two distributions are derived from the Pareto distribution. Long probability tails normally means that probability decays slowly, and can be used to fit a variety of datasets. But if the distribution has symmetric structure with two slow decaying tails, Pareto could not do it. Then Symmetric Pareto or Zero Symmetric Pareto distribution is applied instead.<ref name=":0">Template:Cite journal</ref>

The Cumulative distribution function (CDF) of Symmetric Pareto distribution is defined as following:<ref name=":0" />

<math display="block">F(X) = P(x < X ) = \begin{cases} \tfrac{1}{2}({b \over 2b-X}) ^a & X<b \\ 1- \tfrac{1}{2}(\tfrac{b}{X})^a& X\geq b \end{cases}</math>

The corresponding probability density function (PDF) is:<ref name=":0" />

<math display="block">p(x) = {ab^a \over 2(b+\left\vert x-b \right\vert)^{a+1}},X\in R</math>

This distribution has two parameters: a and b. It is symmetric about b. Then the mathematic expectation is b. When, it has variance as following:

<math display="block">E((x-b)^2)=\int_{-\infty}^{\infty} (x-b)^2p(x)dx = \frac{2b^2}{(a-2)(a-1) }</math>

The CDF of Zero Symmetric Pareto (ZSP) distribution is defined as following:

<math display="block">F(X) = P(x < X ) = \begin{cases} \tfrac{1}{2}({b \over b-X}) ^a & X<0 \\ 1- \tfrac{1}{2}(\tfrac{b}{b+X})^a& X\geq 0 \end{cases}</math>

The corresponding PDF is:

<math display="block">p(x) = {ab^a \over 2(b+\left\vert x \right\vert)^{a+1}},X\in R</math>

This distribution is symmetric about zero. Parameter a is related to the decay rate of probability and (a/2b) represents peak magnitude of probability.<ref name=":0" />

Multivariate Pareto distribution

The univariate Pareto distribution has been extended to a multivariate Pareto distribution.<ref>Template:Cite journal</ref>

Statistical inference

Estimation of parameters

The likelihood function for the Pareto distribution parameters α and xm, given an independent sample x = (x1, x2, ..., xn), is

<math display="block">L(\alpha, x_\mathrm{m}) = \prod_{i=1}^n \alpha \frac {x_\mathrm{m}^\alpha} {x_i^{\alpha+1}} = \alpha^n x_\mathrm{m}^{n\alpha} \prod_{i=1}^n \frac {1}{x_i^{\alpha+1}}.</math>

Therefore, the logarithmic likelihood function is

<math display="block">\ell(\alpha, x_\mathrm{m}) = n \ln \alpha + n\alpha \ln x_\mathrm{m} - (\alpha + 1) \sum_{i=1} ^n \ln x_i.</math>

It can be seen that <math>\ell(\alpha, x_\mathrm{m})</math> is monotonically increasing with xm, that is, the greater the value of xm, the greater the value of the likelihood function. Hence, since x ≥ xm, we conclude that

<math display="block">\widehat x_\mathrm{m} = \min_i {x_i}.</math>

To find the estimator for α, we compute the corresponding partial derivative and determine where it is zero:

<math display="block">\frac{\partial \ell}{\partial \alpha} = \frac{n}{\alpha} + n \ln x_\mathrm{m} - \sum _{i=1}^n \ln x_i = 0.</math>

Thus the maximum likelihood estimator for α is:

<math display="block">\widehat \alpha = \frac{n}{\sum _i \ln (x_i/\widehat x_\mathrm{m}) }.</math>

The expected statistical error is:<ref>Template:Cite journal</ref>

<math display="block">\sigma = \frac {\widehat \alpha} {\sqrt n}. </math>

Malik (1970)<ref>Template:Cite journal</ref> gives the exact joint distribution of <math>(\hat{x}_\mathrm{m},\hat\alpha)</math>. In particular, <math>\hat{x}_\mathrm{m}</math> and <math>\hat\alpha</math> are independent and <math>\hat{x}_\mathrm{m}</math> is Pareto with scale parameter xm and shape parameter nα, whereas <math>\hat\alpha</math> has an inverse-gamma distribution with shape and scale parameters n − 1 and nα, respectively.

Occurrence and applications

General

Vilfredo Pareto originally used this distribution to describe the allocation of wealth among individuals since it seemed to show rather well the way that a larger portion of the wealth of any society is owned by a smaller percentage of the people in that society. He also used it to describe distribution of income.<ref name=":1">Pareto, Vilfredo, Cours d'Économie Politique: Nouvelle édition par G.-H. Bousquet et G. Busino, Librairie Droz, Geneva, 1964, pp. 299–345. Original book archived</ref> This idea is sometimes expressed more simply as the Pareto principle or the "80-20 rule" which says that 20% of the population controls 80% of the wealth.<ref>For a two-quantile population, where approximately 18% of the population owns 82% of the wealth, the Theil index takes the value 1.</ref> As Michael Hudson points out in The Collapse of Antiquity, "a mathematical corollary [is] that 10% would have 65% of the wealth, and 5% would have half the national wealth."<ref>Template:Cite book</ref> However, the 80-20 rule corresponds to a particular value of α, and in fact, Pareto's data on British income taxes in his Cours d'économie politique indicates that about 30% of the population had about 70% of the income.Template:Citation needed The probability density function (PDF) graph at the beginning of this article shows that the "probability" or fraction of the population that owns a small amount of wealth per person is rather high, and then decreases steadily as wealth increases. (The Pareto distribution is not realistic for wealth for the lower end, however. In fact, net worth may even be negative.) This distribution is not limited to describing wealth or income, but to many situations in which an equilibrium is found in the distribution of size or magnitude. The following examples are sometimes seen as approximately Pareto-distributed:

- All four variables of household budget constraints: consumption, labor income, capital income, and wealth.<ref>Template:Cite web</ref>

- The sizes of human settlements (a few large cities, many hamlets/villages)<ref name="Reed">Template:Cite journal</ref><ref name="Reed2002">Template:Cite journal</ref>

- File size distribution of Internet traffic which uses the TCP protocol (many smaller files, few larger ones)<ref name ="Reed" />

- Hard disk drive error rates<ref>Template:Cite journal</ref>

- Clusters of Bose–Einstein condensate near absolute zero<ref name="Simon">Template:Cite journal</ref>

- The values of oil reserves in oil fields (a few large fields, many small fields)<ref name ="Reed" />

- The length distribution in jobs assigned to supercomputers (a few large ones, many small ones)<ref>Template:Cite journal</ref>

- The standardized price returns on individual stocks<ref name="Reed" />

- The sizes of sand particles<ref name ="Reed" />

- The sizes of meteorites

- The severity of large casualty insurance losses for certain lines of business such as general liability, commercial auto, and workers' compensation<ref>Kleiber and Kotz (2003): p. 94.</ref><ref>Template:Cite journal</ref>

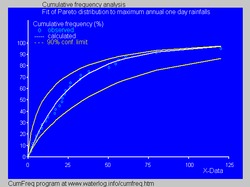

- In hydrology the Pareto distribution is applied to extreme events such as annually maximum one-day rainfalls and river discharges.<ref>CumFreq, software for cumulative frequency analysis and probability distribution fitting [1]</ref> The blue picture illustrates an example of fitting the Pareto distribution to ranked annually maximum one-day rainfalls showing also the 90% confidence belt based on the binomial distribution. The rainfall data are represented by plotting positions as part of the cumulative frequency analysis.

- Electric utility distribution reliability (80% of customer minutes interrupted occur on approximately 20% of the days in a given year)

Relation to Zipf's law

The Pareto distribution is a continuous probability distribution. Zipf's law, also sometimes called the zeta distribution, is a discrete distribution, separating the values into a simple ranking. Both are a simple power law with a negative exponent, scaled so that their cumulative distributions equal 1. Zipf's can be derived from the Pareto distribution if the <math>x</math> values (incomes) are binned into <math>N</math> ranks so that the number of people in each bin follows a 1/rank pattern. The distribution is normalized by defining <math>x_m</math> so that <math>\alpha x_\mathrm{m}^\alpha = \frac{1}{H(N,\alpha-1)}</math> where <math>H(N,\alpha-1)</math> is the generalized harmonic number. This makes Zipf's probability density function derivable from Pareto's.

<math display="block">f(x) = \frac{\alpha x_\mathrm{m}^\alpha}{x^{\alpha+1}} = \frac{1}{x^s H(N,s)}</math>

where <math>s = \alpha-1</math> and <math>x</math> is an integer representing rank from 1 to N where N is the highest income bracket. So a randomly selected person (or word, website link, or city) from a population (or language, internet, or country) has <math>f(x)</math> probability of ranking <math>x</math>.

Relation to the "Pareto principle"

The "80/20 law", according to which 20% of all people receive 80% of all income, and 20% of the most affluent 20% receive 80% of that 80%, and so on, holds precisely when the Pareto index is <math>\alpha = \log_4 5 = \cfrac{\log_{10} 5}{\log_{10} 4} \approx 1.161</math>. This result can be derived from the Lorenz curve formula given below. Moreover, the following have been shown<ref>Template:Cite journal</ref> to be mathematically equivalent:

- Income is distributed according to a Pareto distribution with index α > 1.

- There is some number 0 ≤ p ≤ 1/2 such that 100p % of all people receive 100(1 − p)% of all income, and similarly for every real (not necessarily integer) n > 0, 100pn % of all people receive 100(1 − p)n percentage of all income. α and p are related by <math display="block">1-\frac{1}{\alpha}=\frac{\ln(1-p)}{\ln(p)}=\frac{\ln((1-p)^n)}{\ln(p^n)}</math>

This does not apply only to income, but also to wealth, or to anything else that can be modeled by this distribution.

This excludes Pareto distributions in which 0 < α ≤ 1, which, as noted above, have an infinite expected value, and so cannot reasonably model income distribution.

Relation to Price's law

Price's law is sometimes offered as a property of or as similar to the Pareto distribution. However, the law only holds in the case that <math>\alpha=1</math>. Note that in this case, the total and expected amount of wealth are not defined, and the rule only applies asymptotically to random samples. The extended Pareto Principle mentioned above is a far more general rule.

Lorenz curve and Gini coefficient

The Lorenz curve is often used to characterize income and wealth distributions. For any distribution, the Lorenz curve L(F) is written in terms of the PDF f or the CDF F as

<math display="block">L(F) = \frac{\int_{x_\mathrm{m}}^{x(F)}xf(x)\,dx}{\int_{x_\mathrm{m}}^\infty xf(x)\,dx} =\frac{\int_0^F x(F')\,dF'}{\int_0^1 x(F')\,dF'}</math>

where x(F) is the inverse of the CDF. For the Pareto distribution,

<math display="block">x(F) = \frac{x_\mathrm{m}}{(1-F)^{\frac{1}{\alpha}}}</math>

and the Lorenz curve is calculated to be

<math display="block">L(F) = 1-(1-F)^{1-\frac{1}{\alpha}},</math>

For <math>0<\alpha\le 1</math> the denominator is infinite, yielding L=0. Examples of the Lorenz curve for a number of Pareto distributions are shown in the graph on the right.

According to Oxfam (2016) the richest 62 people have as much wealth as the poorest half of the world's population.<ref>Template:Cite web</ref> We can estimate the Pareto index that would apply to this situation. Letting ε equal <math>62/(7\times 10^9)</math> we have: <math display="block">L(1/2)=1-L(1-\varepsilon)</math> or <math display="block">1-(1/2)^{1-\frac{1}{\alpha}}=\varepsilon^{1-\frac{1}{\alpha}}</math> The solution is that α equals about 1.15, and about 9% of the wealth is owned by each of the two groups. But actually the poorest 69% of the world adult population owns only about 3% of the wealth.<ref>Template:Cite web</ref>

The Gini coefficient is a measure of the deviation of the Lorenz curve from the equidistribution line which is a line connecting [0, 0] and [1, 1], which is shown in black (α = ∞) in the Lorenz plot on the right. Specifically, the Gini coefficient is twice the area between the Lorenz curve and the equidistribution line. The Gini coefficient for the Pareto distribution is then calculated (for <math>\alpha\ge 1</math>) to be

<math display="block">G = 1-2 \left (\int_0^1L(F) \, dF \right ) = \frac{1}{2\alpha-1}</math>

(see Aaberge 2005).

Random variate generation

Random samples can be generated using inverse transform sampling. Given a random variate U drawn from the uniform distribution on the unit interval [0, 1], the variate T given by

<math display="block">T=\frac{x_\mathrm{m}}{U^{1/\alpha}}</math>

is Pareto-distributed.<ref>Template:Cite book</ref>

See also

- Template:Annotated link

- Template:Annotated link

- Template:Annotated link

- Template:Annotated link

- Template:Annotated link

- Template:Annotated link

- Template:Annotated link

- Template:Annotated link

- Template:Annotated link

- Template:Annotated link

- Template:Annotated link

- Template:Annotated link

References

Notes

External links

- Template:Springer

- Template:MathWorld

- Template:Citation

- Template:Cite conference

- syntraf1.c Template:Webarchive is a C program to generate synthetic packet traffic with bounded Pareto burst size and exponential interburst time.